By Chris Rundall

Here in Colorado, consumers pay a 40.4 cents-per-gallon tax on gasoline: of this tax, 18.4 cents goes to the federal government and 22 cents goes to the state. The state tax portion, which funds maintenance and improvements to our state’s roads and bridges, has not changed since 1991. However, inflation and improved vehicle fuel efficiency have reduced the impact fuel tax has on funding transportation improvement projects. As increasing this tax would require voter approval, and anticipating that a tax increase would be not be successful in a public vote, the state approved the FASTER bill in 2009, which increased vehicle registration fees with the goal of bringing in $250 million annually for road and bridge projects.

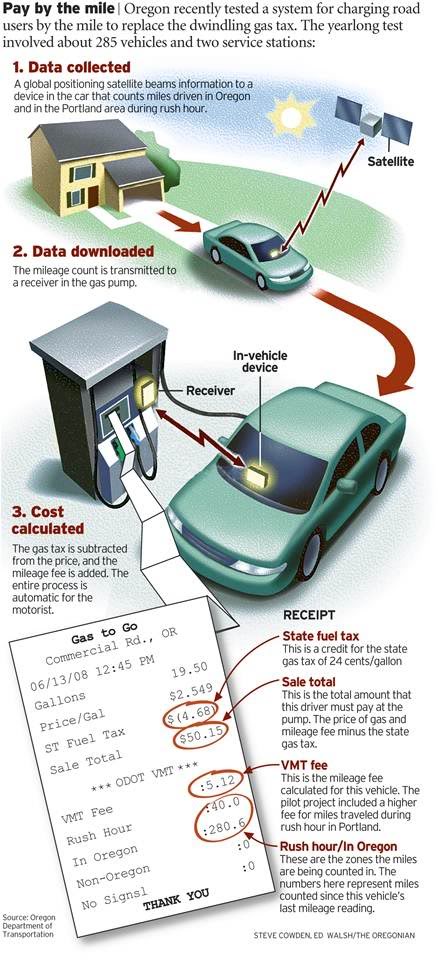

During a CDOT event last year,the current director, Don Hunt, spoke about transportation funding shortfalls and possible funding alternatives that may be explored, such as toll roads and public-private partnerships. Mr. Hunt also mentioned the mileage-based tax idea that has been debated over the last several years, with pilot programs for this concept conducted in Oregon and Minnesota. The following graphic provides the basic concept behind this option. Opponents of the “pay by the mile” approach feel it is an unconstitutional invasion of privacy due to the required in-vehicle device.

This is a complicated issue with no perfect solutions. Ideally, steps are made soon to lead us down a path that provides a more sustainable funding source for our state transportation systems.

For more information, please email chris@baselinecorp.com.